With the SHOT Show having just concluded this past week, I thought it might be a good time to look at investing and the gun industry. As NSSF President Steve Sanetti noted in his State of the Industry address at the SHOT Show, the $4.1 billion firearms and ammunition industry is one of the bright spots in the economy.

Eighteen consecutive quarters of sales growth, as evidenced most recently by an all-time high number of mandatory point-of-sales background checks in December, and during the worst recession since the great depression, would be an enviable feat for any industry. Yet we have achieved it…

If, like most investors, you are saying to yourself that you’d like to invest in an industry that is actually doing well in our poor global economy, when it comes to the firearms industry there are very few choices available. The reason is that much of the industry is in private hands and are not public companies. By public companies, I mean those whose stock trades on a stock exchange.

As I noted, much of the firearms industry is in private hands. Companies such as Groupe Herstal (FNH, Browning, and Winchester firearms), Colt, Beretta, Steyr Mannlicher, and the Freedom Group (Remington, Bushmaster, DPMS, Dakota Arms, Marling, H&R, etc.) are all privately held. While the Cerberus-owned Freedom Group may eventually go public, they pulled their Initial Public Offering back in April 2011.

So where does this leave investors?

In the United States, Sturm, Ruger and Company (RGR) and Smith and Wesson Holding Company (SWHC) are the only two publicly traded firearms manufacturers. Worldwide, you can add Forjas Taurus (Taurus firearms) which trades on the Sao Paolo exchange, Manroy PLC (Sabre Defence and military arms) in the UK, Metal Storm Ltd. of Australia, and a handful of Russian companies like Tula Armory.

Ammunition companies in the United States that are publicly traded include Olin (Winchester ammunition) and Alliant Technologies (Federal, CCI, and Speer). Other companies that are involved in the broad firearms and outdoor market would include Cabelas (CAB), the Outdoor Channel (OUTD), and Taser International (TASR).

Let’s look a little closer at the two US firearms manufacturers and the two ammo companies.

Sturm, Ruger and Company (RGR) is headquartered in Southport, Connecticut and has factories in Prescott, Arizona and Newport, New Hampshire. Its stock trades on the New York Stock Exchange. In terms of market capitalization, Ruger is larger than Smith and Wesson – $736 million versus $309 million – but has about $100 million less in annual gross revenues. Ruger has been doing well and is on track to become the first firearms manufacturer to sell one million firearms in a one year period. The stock has also been doing well as can be seen in the chart below. Over the last two years, Ruger’s stock price has risen 250% and it closed at $38.68 per share on Friday. Looking at the chart, you can see that it significantly outperformed the Standard and Poor’s 500 Index.

Smith and Wesson Holding Company (SWHC) is headquartered in Springfield, Massachusetts. They moved their Thompson Center manufacturing to Springfield from New Hampshire. Smith and Wesson also has non-firearms operations in Houlton, Maine and Franklin, Tennessee. The company is also a leading manufacturer of handcuffs and provides physical security products through their Security Solutions division. As noted above in the discussion Ruger, Smith and Wesson has a smaller market cap than Ruger but has about $100 million more in annual revenues. However, when it comes to profitability, Ruger both has a higher profit margin and more profits than Smith and Wesson. The stock price of SWHC reflects this. It closed on Friday at $4.74 per share and is only up about 20% for the last two years. Looking at the chart, you can see its stock price has been very volatile.

Neither of the U.S. ammunition manufacturers, Olin and Alliant Technologies, are solely ammo makers. Olin also makes chlor alkali products which are basic materials used in other industries. Alliant Technologies is a large defense contractor involved in aerospace and missile technologies, armament systems, and small arms ammunition manufacturing for the military.

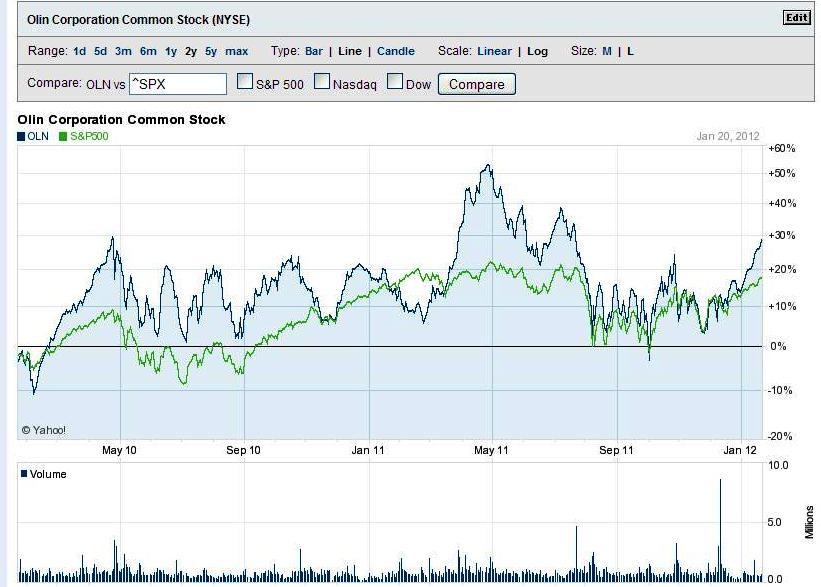

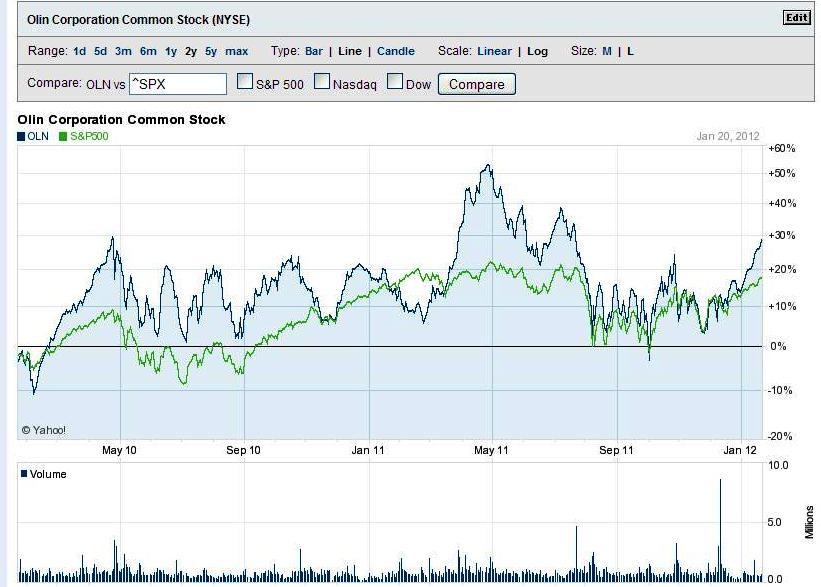

Olin (OLN) has making powder and ammunition for over 100 years from its beginnings with the Equitable Powder Company and Western Cartridge in East Alton, Illinois. Olin bought Winchester out of receivership in 1931 and has owned it ever since. They spun off the Winchester Arms division to U.S. Repeating Arms in 1981. Currently headquartered in the St. Louis suburb of Clayton, Missouri, they make Winchester ammunition in East Alton, Illinois; Oxford, Mississippi; and Geelong, Australia. Olin has been moving more and more ammunition production from East Alton to Oxford due to union-management issues and a more modern facility. In terms of market capitalization, Olin is valued at $1.7 billion, has gross revenues of $1.9 billion, and net income of $225 million. Its stock closed at $22.20 per share on Friday and it trades on the New York Stock Exchange. Olin’s stock price has been volatile over the last two years but it has outperformed the S&P 500 growing 30% in value over the period.

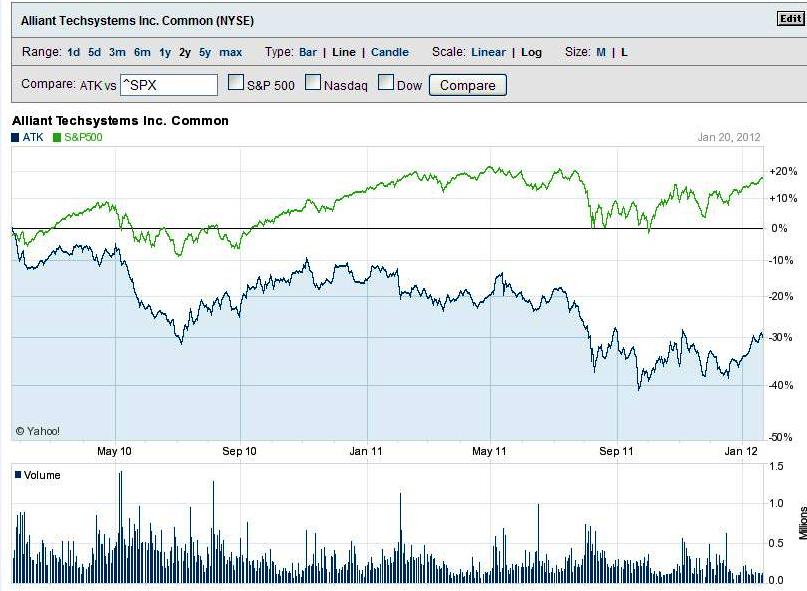

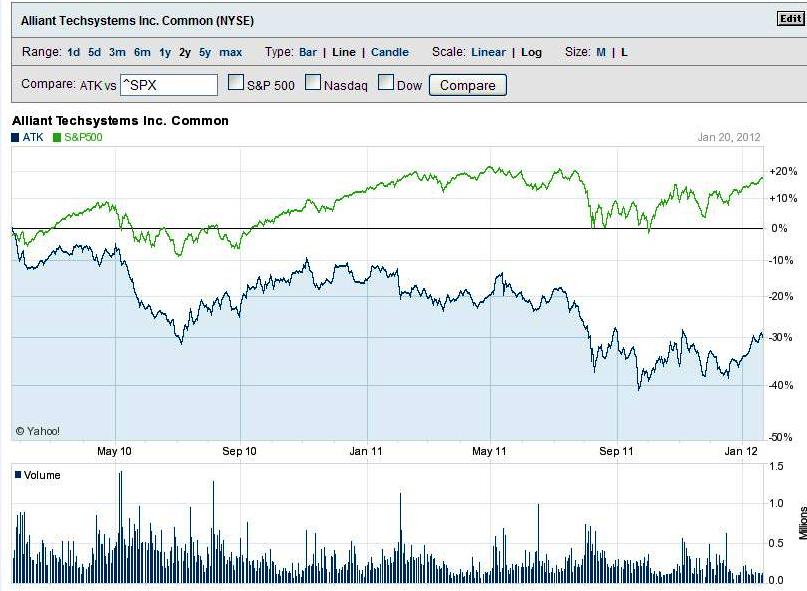

As I noted earlier, Alliant Technologies (ATK) is a major defense contractor. The civilian ammunition component of their business comprises only about 20% of their overall business. Their Security and Sporting Group is comprised of Federal Premium ammo, CCI ammo and components, Speer bullets and ammo, RCBS reloading equipment, Alliant Powder, Champion ammo, Weaver optics, Eagle Industries, and Blackhawk! Industries.Alliant Technologies is headquartered in Arlington, Virginia and has 60 facilities in 22 states, Puerto Rico, and internationally. ATK has a market cap of $2.04 billion, has gross revenues of $4.62 billion, and net income of $292 million. Its stock closed at $61.78 per share and it trades on the New York Stock Exchange. As can be seen from the chart below, it has underperformed the market for the last two years and its stock price has lost 30% of its value.

Of the four companies, Ruger is the purest play in firearms. While the company does own Pine Tree Castings, it only provides about 1% of their revenues. The other three companies are more diversified. This diversification which in normal times would help them seems to have depressed their growth as compared to that of Ruger. With other sectors of the economy not having the robust growth of the firearms industry, this has hurt Smith and Wesson, Olin, and Alliant Technologies.

Because of my day job, I am not permitted to make any recommendations. I suggest that you do your own research, check with your own investment advisor, and go from there if you are interested in investing in the companies of the firearms and ammunition industry.

Disclosure: In the spirit of full disclosure, I own shares in RGR, ATK, OLN, and SWHC. Nothing here should be taken as an investment recommendation nor a solicitation of your business.