In the last week and half there have been a number of updates in the NRA’s Chapter 11 bankruptcy case. I will take them in order.

First, there was a debtor’s motion (the NRA) to allow Brewer, Attorneys and Counselors, to serve as special debtor’s counsel in the case. While the entire filing is 53 pages long, here are some excerpts. It should be kept in mind that the NRA has retained Patrick Neligan of Neligan LLP as its bankruptcy specialist attorney. Mr. Neligan has been practicing high-level bankruptcy law for over 35 years.

BAC and its attorneys are well-positioned to handle these matters for the Debtors because BAC has accumulated a reservoir of knowledge that could not be efficiently offloaded to, or replicated by, substitute counsel.

One way of looking at Brewer’s statement is that they know where the bodies are buried. I don’t think that is their intention but it could be read that way and they are needed to keep them buried.

In 2020 and in 2021, BAC’s standard hourly rates were as follows:

Professionals 2020 Hourly Rates

Founding Partner, William A. Brewer III $1,400

Partner $700-$900

Associate $275-$600

Consultant/Analyst $250-$725

Investigator $250-$350

Public Affairs $375-$800

Are their fees capped?

Did you agree to any variations, or alternatives to, your standard or customary billing arrangements for this engagement?

Response:

Yes. For one of the matters, BAC agreed not to seek fees for its professionals’ time inexcess of $100,000.10 In addition, BAC represents the NRA in another matter pro bono. Otherwise, BAC has not agreed to any variations or alternatives to BAC’s standard or customary billing arrangements. BAC’s engagement by the Debtors in connection with the Debtors’ bankruptcy cases is to serve as special counsel to the Debtors in the litigation that began PrePetition and other related matters BAC has been handling for the Debtors, as well as to assist Neligan LLP (lead counsel to the Debtors) during a transition period after the filing of the chapter 11 cases in order to facilitate the quick, efficient handling of matters drawing on BAC’s institutional knowledge.

In other words, with regard to one aspect of the case they will limit their fees as per agreement to $100,000 but after that the sky is the limit.

Remember that the bankruptcy filing has put many of the NRA’s other cases on hold so Brewer, Attorneys and Counselors has got to make their money somehow.

The Special Litigation Committee of Carolyn Meadows, Charles Cotton, and Willes Lee think having Bill Brewer involved is just dandy and they are all for it. Then again, they pretty much do as they are told by Wayne LaPierre.

Moving on, a mailing list of all additional creditors of the NRA was filed with the court on Monday, February 1st. Included in that 247-page list was the NRA Foundation. It should be remembered that most of the firearms in the National Firearms Museum and the National Sporting Arms Museum are not property of the NRA. Rather, they are on loan from primarily the NRA Foundation as that was to whom they were gifted by donors.

In a February 2nd report by Reuters on the latest hearing in the case before Bankruptcy Judge Harlin D. Hale, attorney Patrick Neligan denied the Chapter 11 filing was in bad faith.

“This is not a bad faith filing and we look forward to using Chapter 11

to resolve litigation and to move forward to emerge out of this

bankruptcy as a company domiciled here in Texas,” Neligan said

during Wednesday’s hearing.

The question of whether the NRA filed the bankruptcy in good faith could arise if the judge is asked to dismiss the case.

Judge Hale did ask both the NRA and the NY Attorney General’s Office to scale back the rhetoric and treat this as “a regular bankruptcy case.”

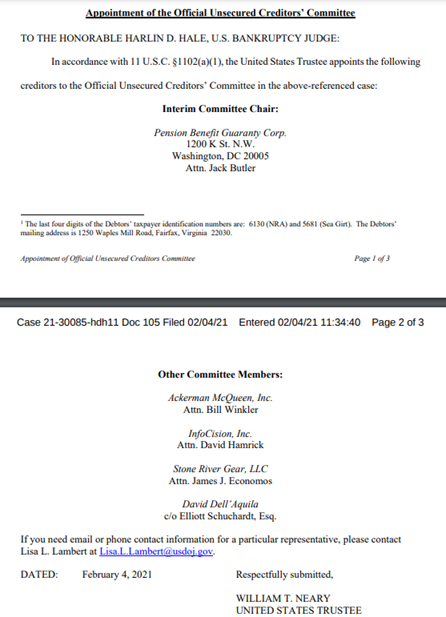

The US Trustee in the case appointed an Official Unsecured Creditors Committee consisting of five members. The Pension Benefit Guaranty Corp. was appointed the interim chair of the committee. As seen in the screen shot below, two of the committee appointees will probably cause a bit of consternation in Fairfax as well as in the offices of Bill Brewer.

I sincerely doubt that either AckMac or David Dell’Aquila are going to roll over and play dead for Wayne and the NRA.

Finally, in an interview posted today in FreeBeacon.com by Stephen Gutowski, Mr. Dell’Aquila says he will be pushing for a court-appointed trustee to oversee the NRA’s operations.

“We’re going to definitely do a motion for a trustee,” Dell’Aquila said. “I would not be surprised if the majority of the other creditors don’t join or do a similar thing.”

The article goes on to note that the court could appoint a trustee and that such a trustee would have broad powers. That trustee could “displace” the current leadership and the board. Moreover, the trustee would have the fiduciary duty to act in the best interests of the creditors and could go after Wayne and others for misuse of the NRA’s money for personal expenses.

“It’s in everybody’s best interest to get a trustee in there, certainly from the creditors’ point of view, and, I would argue, even for the five million members because every dime that they waste in frivolous litigation is a dime less that could go to the core mission,” Dell’Aquila said.

As might be expected, attorney Bill Brewer who had previously dismissed the idea of a trustee back in January expressed his disappointment that Dell’Aquila was on the committee.

“The NRA is disappointed that a disgruntled individual who has filed frivolous claims against the Association is appointed to the committee,” Brewer told the Free Beacon.

Dell’Aquila’s attorney Elliott Schuchardt said that even with some of the defendants dismissed in Dell’Aquila’s class-action suit, the remaining claim against the NRA is worth $64 million potentially making it the largest creditor.

“We think there’s enough evidence of fraud here that we can make a good faith argument to the bankruptcy court judge that somebody else should be running the NRA,” Schuchardt said.

I have always held that this bankruptcy filing was a gamble. Wayne and Brewer are too clever by half and I think the result will not be to their liking.

There is another hearing scheduled in the case for Wednesday, February 10th by WebEx. I’m sure we will hear something more then.