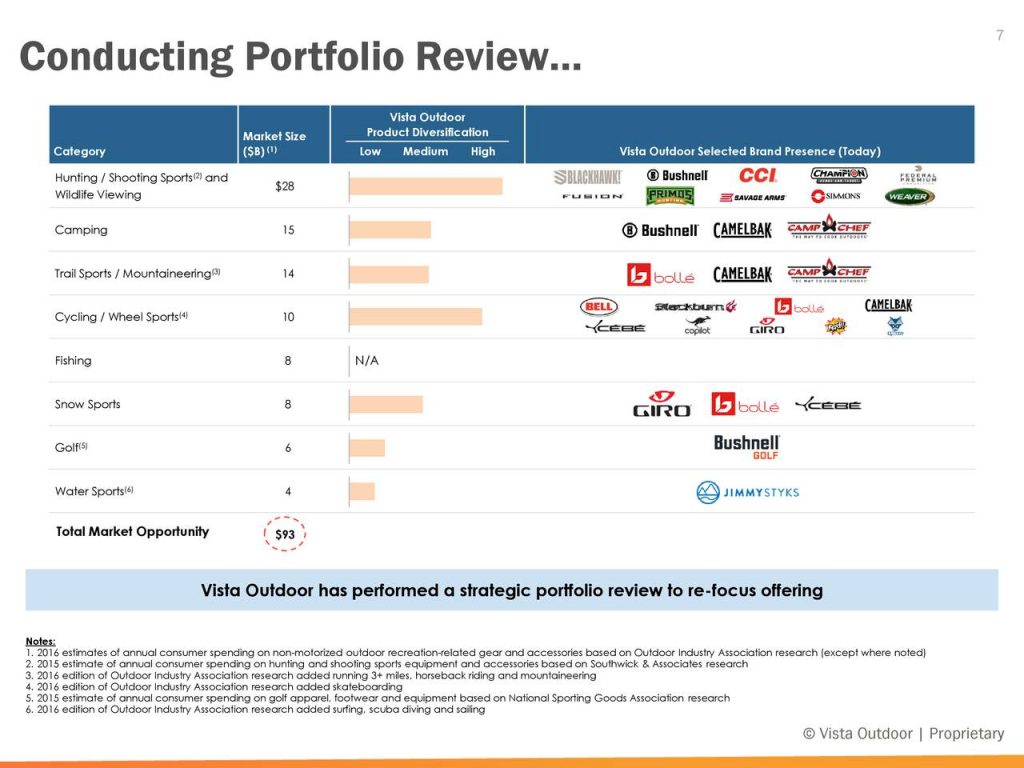

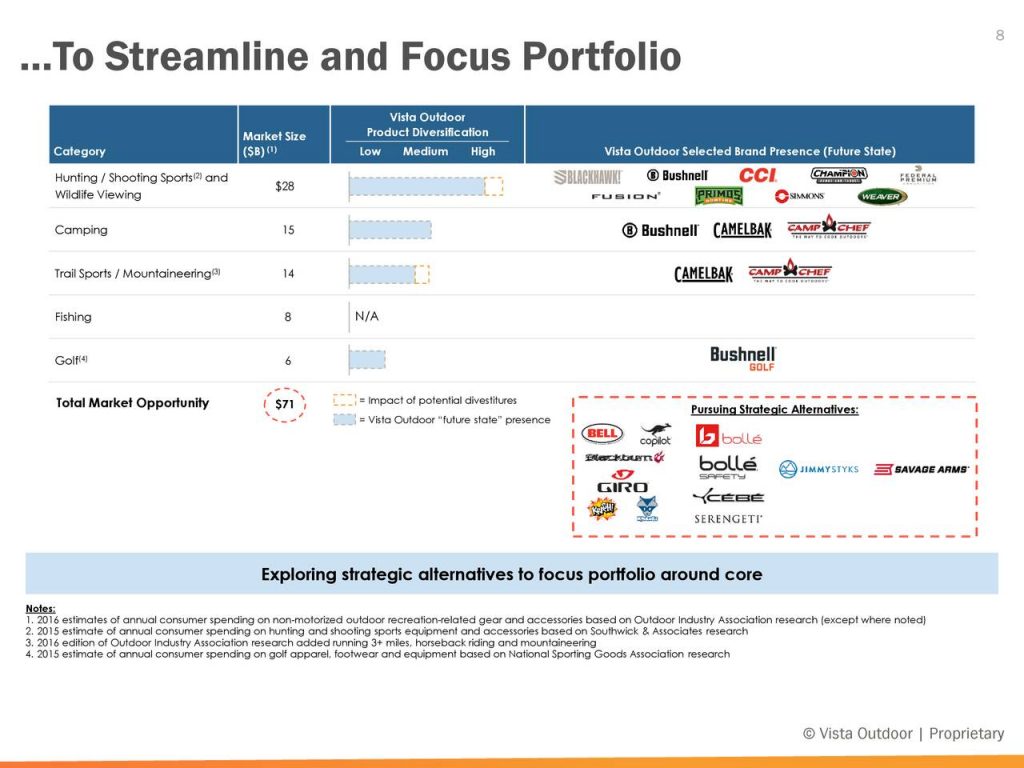

ATK – formerly known as Alliant Techsystems – announced today that they were buying Caliber Company. Caliber is the parent company of Savage Sports Corporation. This marks the first true firearms company owned by ATK. They make ammunition under a number of labels including Federal Premium, CCI, Fusion, Speer, Estate Cartridge and Blazer. They also own a number of companies in the firearm accessory and reloading field including BLACKHAWK!, Alliant Power, RCBS, Champion targets and shooting

equipment, Gunslick Pro and Outers gun-care products, and Weaver optics

and mounting systems.

Savage got an equity infusion early in 2012 from NorWest Equity Partners. While no numbers were mentioned when NEP made the investment in Savage, I’m sure the $315 million in cash that ATK is paying represents a significant return on their investment.

From ATK’s press release which provides more details:

ARLINGTON, Va., May 13, 2013 /PRNewswire/ — ATK (NYSE: ATK) announced it has entered into an agreement to acquire Caliber Company, the parent company of Savage Sports Corporation. Savage is one of the world’s largest manufacturers of hunting rifles and shotguns, delivering innovative products for more than 100 years. The acquisition would expand ATK’s portfolio offering by adding long guns to its leading brands in commercial and security ammunition, shooting sports and security-related accessories. The transaction is subject to regulatory approvals and customary closing conditions. ATK anticipates closing the transaction in the first quarter of its Fiscal Year 2014 (FY14), which ends June 30, 2013.

Under the terms of the transaction, ATK will pay $315 million in cash, subject to a customary working capital adjustment. This represents a trailing twelve months ended March 31, 2013 EBITDA multiple of approximately 5.5 times (unaudited). ATK believes the acquisition will be accretive to FY14 earnings per share. ATK will finance the acquisition with cash on hand and funds available under its existing credit facility.

“The acquisition will complement ATK’s growing portfolio of leading consumer brands,” said Mark DeYoung, ATK President and CEO. “This opportunity will allow us to build upon our offerings with Savage’s prominent, respected brands known for accuracy, quality, innovation, value and craftsmanship. Savage’s sales distribution channels, new product development, and sophistication in manufacturing will significantly increase our presence with a highly relevant product offering to distributors, retailers and consumers.”

Operating under the brand names of Savage Arms, Stevens, and Savage Range Systems, the company designs, manufactures and markets centerfire and rimfire rifles, shotguns and shooting range systems used for hunting as well as competitive and recreational target shooting. The company was organized in 1894 by Arthur Savage and has expanded into market-leading positions. Savage is located in Westfield, Mass. and Lakefield, Ontario, and employs approximately 600 skilled employees.

“Savage offers customers a unique value proposition that is unmatched by any other firearms manufacturer and will be a tremendous complement to ATK’s existing ammunition and shooting accessories portfolio,” said Al Kasper, Savage President and Chief Operating Officer.

ATK will integrate Savage within its Sporting Group business. ATK’s Sporting Group is the established leader in sporting and law enforcement ammunition and shooting accessories. ATK’s ammunition brands include Federal Premium, CCI, Fusion, Speer, Estate Cartridge and Blazer. ATK’s accessories brands include BLACKHAWK!, Alliant Power, RCBS, Champion targets and shooting equipment, Gunslick Pro and Outers gun-care products, and Weaver optics and mounting systems.

Caliber Company has been a portfolio company of Norwest Equity Partners (NEP), a leading middle market equity investment firm, since January 2012. NEP is headquartered in Minneapolis, Minn.

ATK is an aerospace, defense, and commercial products company with approximately 15,000 employees and operations in 21 states, Puerto Rico, and internationally. ATK is headquartered in Arlington, Va. News and information can be found on the Internet at www.atk.com, on Facebook at www.facebook.com/atk, or on Twitter @ATK.

UPDATE: More on the acquisition of Savage by ATK from The Republican of Springfield, MA.

Bill Dermody, director of marketing at Savage, he had no information about how the sale will impact operations and employment in Westfield. The deal doesn’t become official until June.

But he did say ATK doesn’t manufacture firearms now, despite the fact that its brand portfolio includes standbys like Federal ammunition. ATK’s shooting accessories businesses make backpacks, cartridge bags gun-cleaning kits and other products. Up until now, the company didn’t make guns themselves.

“They don’t have a firearms factory. There just doesn’t seem to be any redundancy there,” Dermody said. “They are bolting us on to their organization.”….

A private company, Savage has grown in each of the last five years. But Dermody said figures will not be released because it is a private company.

Savage sold 645,000 firearms last year, mostly bolt-action rifles. That is a third of the total market for traditional firearms. Savage’s guns are designed for the recreational market of target-shooters and hunters and are sold through major retailers such as Dick’s Sporting Goods and Cabela’s.