Vista Outdoor announced plans today to sell off its Savage and Stevens line of firearms along with stuff like bike helmets and paddle boards. According to the announcement on their website, they are engaging in a strategic business transformation plan to emphasize products core to business. This will include their ammunition business which is their largest core business.

Vista Outdoor Inc. (NYSE: VSTO) today announced its strategic business transformation plan, designed to allow the company to focus resources on pursuing growth in its core product categories. The plan is a result of a comprehensive strategic review, which began in November 2017.

“Our review identified product categories that are core to the company’s long-term business strategy,” said Vista Outdoor Chief Executive Officer Chris Metz. “We believe future investment should focus on categories where Vista Outdoor can achieve sustainable growth, maximize operational efficiencies, deliver leadership economics, and drive shareholder value.”

In conducting the strategic review, Vista Outdoor management defined several criteria to evaluate whether individual product categories are part of the company’s core. Vista Outdoor evaluated brands within its current portfolio based on their ability to do the following:

- Serve the company’s target consumer – the outdoor enthusiast

- Create cross-selling and other similar synergy opportunities

- Achieve market leading positions and leadership economics

- Demonstrate omni-channel distribution capabilities

As a result of this evaluation, and with support from its board of directors, Vista Outdoor will focus on achieving growth through its market-leading brands in ammunition, hunting and shooting accessories, hydration bottles and packs, and outdoor cooking products.

“Vista Outdoor is excited about the potential of each of our core businesses, particularly ammunition, which is our largest core business.” said Metz. “An increased focus on our heritage ammunition business will manifest itself in more innovative and breakthrough new products introduced over the next few years. We also anticipate that by prioritizing this business, we will be able to invest more capital to further enhance and expand our global leadership position.”

The company plans to explore strategic options for assets that fall outside of these product categories, including its remaining Sports Protection brands (e.g. Bell, Giro, and Blackburn), Jimmy Styks paddle boards, and Savage and Stevens firearms. Vista Outdoor expects that the execution of this process will significantly reduce the company’s leverage, improve financial flexibility and the efficiency of its capital structure, and provide additional resources to reinvest in core product categories, both organically and through acquisition.

“This transformation plan is a significant first step toward creating a portfolio of brands that is laser-focused on our target consumer and leverages the strengths of our combined platform,” said Metz. “This renewed focus will allow us to invest in these categories and their natural adjacencies. Coupled with our previously announced sales and marketing reorganization to drive a founder’s mentality back into our brands, this strategic orientation will also allow us to accelerate our efforts to expand e-commerce capabilities and increase our emphasis on market-leading product innovation. The end result will be a Vista Outdoor that lives up to the potential envisioned three years ago when the company was formed. We intend to begin the portfolio reshaping immediately, and anticipate executing any strategic alternatives by the end of Fiscal Year 2020.”

Savage had only been a part of Vista Outdoor and its predecessor ATK since May 2013 when ATK bought Caliber Company.

In comments made to the Wall Street Journal, CEO Chris Metz said:

Chief Executive Chris Metz, who joined the company in October, said brands built up through a series of acquisitions by the previous management team had failed to gel, denting sales and margins over the past two years. Vista Outdoor has seen two-thirds of its market value wiped away over the past two years as industry oversupply and bankruptcies among retailers have hit the broader shooting-sports industry…

Mr. Metz said the Savage Arms business remained “close to our core,” but Vista Outdoors wasn’t prepared to make the investment needed to make it a full-service firearms maker.

He added that they were in no hurry to sell these assets. While I don’t care what they do with paddle boards or bicycle helmets, I don’t want to see a venerable firearms company which still makes an excellent product just dumped on the market. I don’t know if they can get the $315 million they paid for Savage back in 2013 but time will tell.

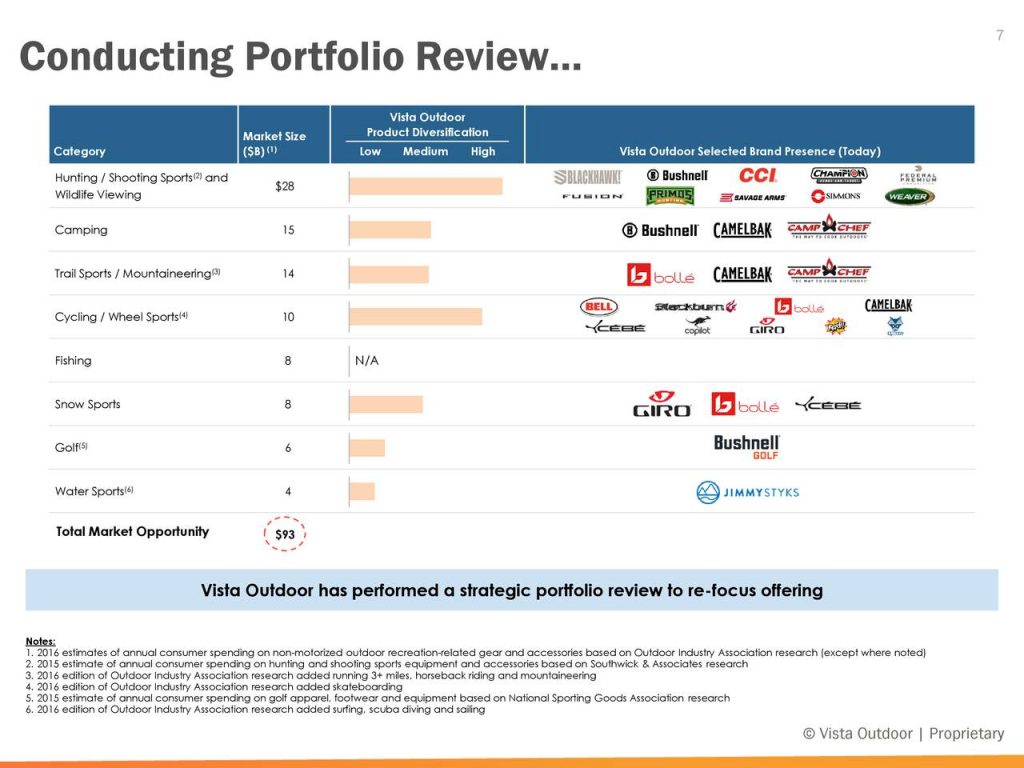

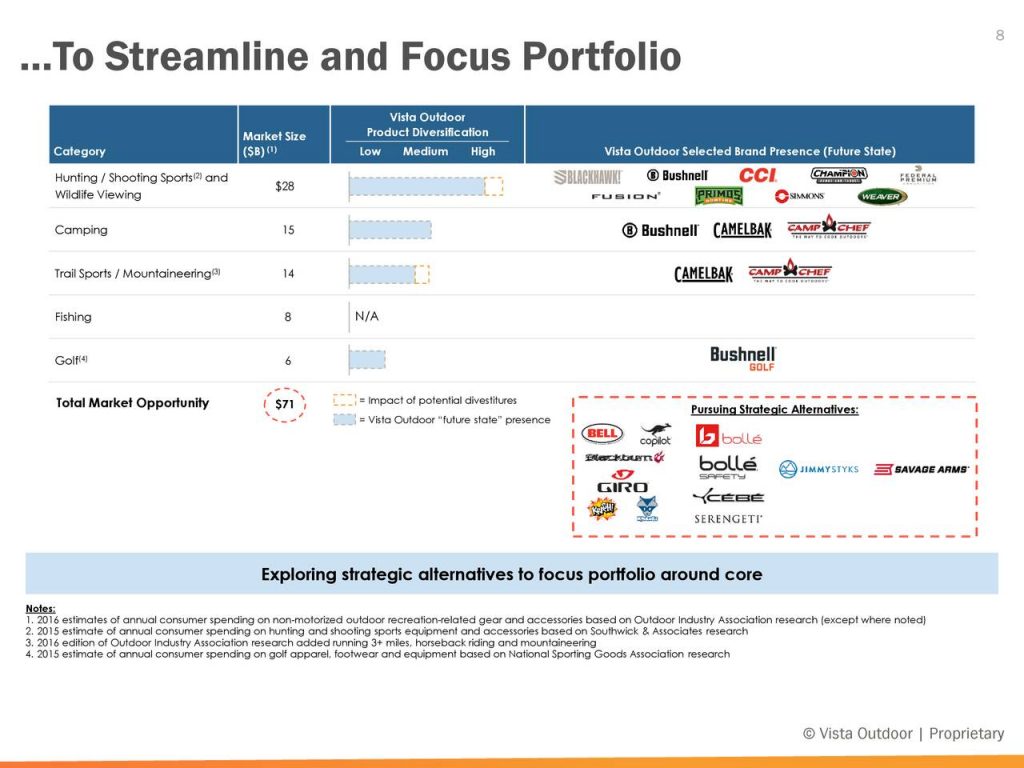

UPDATE: Attached are two slides from the Vista Outdoor analyst presentation today which show the before and after of the potential spin-off of Savage and the others.

|

| BEFORE |

|

| AFTER |