This is going to be a quick post without much detail or analysis as I am heading out of town shortly.

First, the US Supreme Court ruled unanimously in favor of the NRA in the case of National Rifle Association v. Vullo. The court’s opinion was written by Justice Sonia Sotomayor. The full 31-page opinion is here. Justices Gorsuch and Jackson had concurring opinions. The SCOTUS vacated the 2nd Circuit’s decision and remanded for further proceedings.

From the opinion:

Six decades ago, this Court held that a government entity’s “threat of invoking legal sanctions and other means of coercion” against a third party “to achieve the suppression” of disfavored speech violates the First Amendment. Bantam Books, Inc. v. Sullivan, 372 U. S. 58, 67 (1963). Today, the Court reaffirms what it said then: Government officials cannot attempt to coerce private parties in order to punish or suppress views that the government disfavors. Petitioner National Rifle Association (NRA) plausibly alleges that respondent Maria Vullo did just that. As superintendent of the New York Department of Financial Services,

Vullo allegedly pressured regulated entities to help her stifle the NRA’s pro-gun advocacy by threatening enforcement actions against those entities that refused to disassociate from the NRA and other gun-promotion advocacy groups. Those allegations, if true, state a First Amendment claim.

I would see also Stephen Gutowski’s report on this as it will be updated. There is no official comment from the NRA as of yet but they did have this graphic posted on Twitter.

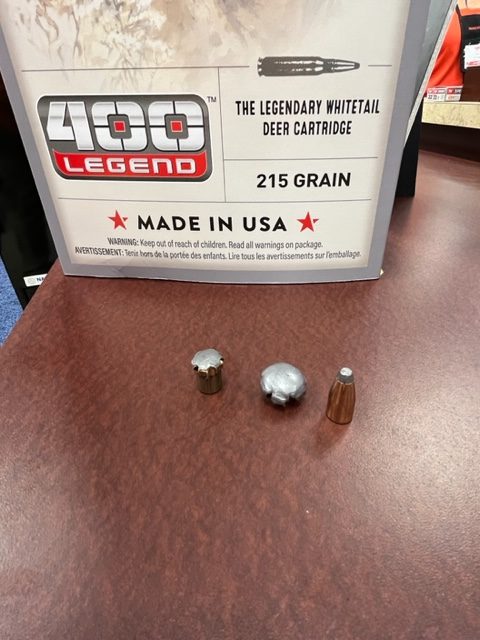

The other story that I’ve been following broke a couple of days ago. Vista Outdoor rejected the revised offer from MNC Capital while confirming their acceptance of the offer from Czechoslovak Group (CSG) for the Kinetic Group aka Vista’s ammo business. CSG has also increased their offer by $50 million which makes it a total of $1.96 billion. Assuming that the shareholders approve it and the Committee on Foreign Investment in the United States allows the transaction to continue, Vista shareholders will receive one common share of Revelyst stock and a cash payment of $16 for every current share of Vista Outdoor owned.

The Wall Street Journal had a long article on this transaction on May 22nd. It paid particular attention to the objections of Sen. J. D. Vance (R-OH) and former Sec. of State Mike Pompeo. The major emphasis of their objections seem to be that it would give a foreign company too much control of the US gunpowder, primer, and ammo market.