Now that the One Big Beautiful Bill has been passed and signed the $200 tax on suppressors, short barreled rifles and shotguns, and NFA any other weapons will disappear as of January 1, 2026. Many suppressor retailers such as Silencer Central and Silencer Shop will more than likely be running promotions between then and now where they will pay the $200 tax.

Despite the tax being gone, all the other onerous provisions of the National Firearms Act on these suppressors and weapons will still be in effect. This will include background checks requiring fingerprints and photos, restrictions on taking SBRs and SBSs across state lines, and, of course, registration with the government.

The rationale for the legitimacy of the National Firearms Act going back to the 1930s was that it was a tax with associated regulations as opposed to regulations with a fee attached. Now that the tax will be zero as of January 1, 2026, that legitimacy will be called into question. Two different coalitions will file or have filed suits in Federal court challenging the NFA on these grounds.

The coalition composed of the Silencer Shop Foundation, Gun Owners of America, Firearms Regulatory Accountability Coalition, B&T USA, Palmetto State Armory, SilencerCo, Gun Owners Foundation, and Brady Wetz have filed suit in the Northern District of Texas as of July 4th. Their attorneys are Stephen Stamboulieh and the DC firm of WileyRein LLP. This lawsuit contends that the NFA’s registration and transfer requirements exceed Congress’ Article I powers with regard to untaxed firearms. Thus, it seeks a declaratory judgment that this portion of the NFA is unconstitutional along with a permanent injunction against the ATF and the Department of Justice on enforcement of any part of the NFA pertaining to untaxed firearms.

The second coalition is composed of the NRA, the Second Amendment Foundation, Firearms Policy Coalition, and the American Suppressor Association. It is my understanding that they hope to be filing suit early this coming week with the well-known 2A law firm of Cooper & Kirk representing them. I am hoping that it actually will be Monday as that is Bastille Day which celebrates that storming of the gates of the Bastille in Paris. Instead of storming the gates of the Bastille, this lawsuit would storming the gates of an unconstitutional law.

Litigation is expensive. It is an unfortunate fact of life especially if you challenging the Federal government in court. Herein comes my suggestion on using part of the tax savings to support this litigation.

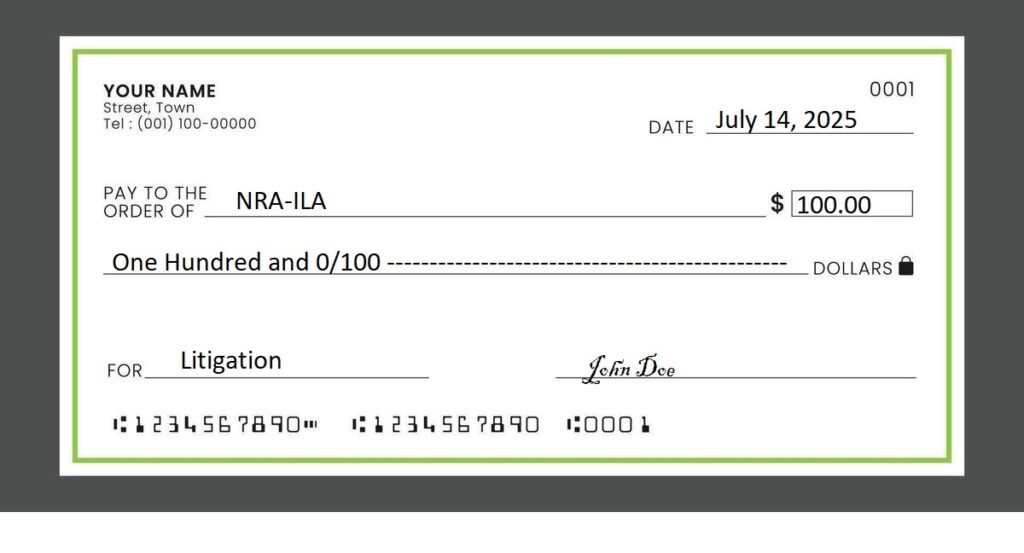

Take half your tax savings or $100 and send it to NRA-ILA to help support the litigation. Make sure to put “litigation” in the memo field. That will designate it specifically for litigation and I’m assured by NRA-ILA Executive Director John Commerford that it will be used for litigation. Mail that check to NRA-ILA, 11250 Waples Mill Road, Fairfax, VA 22030.

Alternatively, if you want to support the other coalition’s lawsuit, Palmetto State Armory is doing a special run of AR-15 stripped lowers marked “GOA-15”. $25 of each one sold at $59.95 will go to GOA to help fund that coalition’s litigation against the NFA. They are hoping to raise $250,000 this way.

My preference is to send the money to NRA-ILA. While I am a NRA Director, my preference is based upon the fact that I already have a number of stripped AR lowers in my gun safe and, more importantly, that 100% of the money will be used for litigation.

What to do with the remaining $100 in tax savings? I have some ideas about that as well.

Large numbers have a power all their own. An organization with a large membership will, all things being equal, have greater influence with politicians than smaller one. Despite the growth of the other Second Amendment organizations such as GOA, FPC, SAF, and even NAGR, the National Rifle Association still remains the largest even despite its past problems. If you have read my past posts, I take a Laswellian approach to politics and who gets what, when, and how is quite often determined by size.

Let’s set aside $50-70 to buy memberships in the NRA for friends and relatives. For example, you could buy five Associate memberships for $50. Conversely, we on the Membership Committee have been discussing creating a $25 digital membership where you are a full member but get the magazine in a digital format and are not sent any welcome trinkets. You could buy two of those for $50. Even now, you can find a regular NRA Annual membership for $35 if you search. Given that over 10 million people think they are NRA members but aren’t, imagine if even one-third actually became members. That would double the membership of the NRA overnight and return fear as a component of the NRA’s relationship with politicians. Being feared by politicians is a good thing.

With the remaining $30-50, I suggest buying a box or two of subsonic ammo.

Alternatively, you could get a carbine-length buffer tube kit and a carbine stock to convert your AR pistol into a SBR. I certainly will be considering this if the regulations were to go away.

The stark reality is that it is going to take money to get the NFA regulations on untaxed firearms to go away. Even if we win in US District Court, there is nothing to say a win won’t be appealed and then appealed again. I say spend the potential savings now so we can get what we really (really!!!!) want.

John, one note on why I expect AR pistols will still be a thing even after NFA Strikedown. Some states have absurdities in law like “rifles in cars ALWAYS prohibited and pistols ONLY permitted with CCW”–my own is one of these, but despite them now being banned grandfathered AR pistols are still legally covered by CCW.

Asininities of Local 2A Infringements…

We’ll know what kind of Barbie-styled bag of bullcrap Red-Flag Pam is when we see if Trump’s DOJ chooses to fight the suit or agrees that it is unconstitutional. Right now if she’s running Dan Bongino (who I have an immense amount of respect and trust for as a former fellow protective professional) out the door that does not lend me confidence in her fitness for the job.

You bring up a good point about the role of state laws. If I remember correctly, SBRs are banned in California but an AR pistol is legit because it is a pistol.

Assuming it’s not BBQ’ed on other “Assault Weapon” classes. Here in WA, AR receivers and all built on them are banned but existing are grandfathered – at the time it dropped I was actually penciling out a straight-pull AR15 pistol in .300BLK. (Re my prior, somehow the word “LOADED” didn’t get in on WA laws – some of the Fischgestapo will even go apecrap over a loaded MAGAZINE even if it’s in a separate locked case. However, an AR pistol on your person/personal bag… well, when my gal saw the 12.5″ break-in-half M4 the Air Force built for survival kits her response was “PURSE GUN!”)

Worth doing to chip in on both lawsuits, for those who can.