Ed Head of Gunsite Academy and Downrange TV discusses the new firearms introduced by Sturm, Ruger for 2013. They include the SR1911 in Commander length, the LC390, new variants of the Scout Rifle, the Ruger Guide Rifle, and a number of .22 LR pistols.

Ruger

This Should Convince You That The Fiscal Cliff Is Real

In what I consider a combination of gun and financial news, Sturm, Ruger & Company declared a special dividend of $4.50 per share. By contrast, their regular third quarter dividend was 38.2 cents. While CEO Michael Fifer says in the statement below that this special dividend will increase Ruger’s return on shareholder’s equity, I can’t help but wonder if tax considerations also played a role in this.

Come January 1, 2013, there will be a new 3.8% Medicare tax on investment income including dividends for individuals with adjusted gross incomes over $200,000 and couples with adjusted gross incomes over $250,000. In addition, dividends for those in the 25 % or above tax brackets are currently taxed at 15% and nothing if one is in the 10 or 15% bracket. If Congress and the President do not come to an agreement and the Bush-era tax reductions revert to their old levels, dividends will be taxed at 10% for those in the 15% tax bracket and 20% in any bracket above that. Thus, some taxpayers could be seeing their dividends taxed as high as 23.8% or an almost 59% increase over current levels.

The takeaway is that the fiscal cliff is real, taxes do matter when it comes to investments, and that companies are taking it seriously. Now if only those within the Beltway were equally as serious.

Sturm, Ruger & Company, Inc. (NYSE: RGR) announced today that its Board of Directors voted to declare a special dividend of $4.50 per share on the Company’s issued and outstanding shares of common stock. This cash dividend will be paid on December 21, 2012 to shareholders of record as of December 7, 2012.Chief Executive Officer Michael O. Fifer commented on the special dividend, “The decision to return this cash to our shareholders was based on an analysis that indicates we can continue to fund our high rate of organic growth, including expected increases in both working capital and capital expenditures, and fund our quarterly dividend while still growing our cash reserves at a modest rate. In addition, the special dividend will substantially increase the Company’s return on our shareholders’ equity, as the equity will now more accurately reflect the net assets being used in the conduct of the business. Likewise, after the special dividend, our long-term investors will still own the same future stream of earnings, resulting in an increase to their return on investment.”

Mr. Fifer concluded, “This special dividend reflects our confidence in the future to be able to pursue good opportunities that come our way. We remain committed to our new product development strategy and will continue to seek accretive acquisition opportunities and prudently expand our manufacturing capacity.”

As The Stock Markets Tumble….

The stock market is seeing an across the board sell-off today. As I write at approximately 12pm EST, all major stock market averages – the Dow, S&P 500, and the NASDAQ – are down approximately 2.3%. Part of it is news from Europe that a recession there is all but a certainty and part is the election results along with the “fiscal cliff”.

Coal stocks, as might be expected given Obama’s jihad against coal, are down even more.

But guess what two companies are seeing strong increases in their stock prices.

That’s right – Ruger and Smith & Wesson. Currently, Ruger (RGR) is up $2.40 or a 5.38% increase while Smith & Wesson (SWHC) is up 77 cents or an 8.14% increase over yesterday. Both of these are pure plays on the firearms market.

The ammo makers Olin (Winchester) and ATK (Federal) are down. However, they have other businesses besides just ammunition production. ATK, in addition to making ammunition, is a significant defense contractor while Olin is a big producer of chlor-alkali.

UPDATE: Bloomberg TV has noticed just how well gun makers’s stock is doing today as well.

“We’re Doing Really Well” – Mike Fifer, Ruger CEO

Sturm, Ruger and Co., Inc. will be featured in the November 5th edition of Forbes Magazine. That issue will feature Forbes’ Best Small Companies in America list and Ruger is number four on the list.

Intimacy with the product–and the customer–has been key to Ruger’s turnaround. That, plus embracing industry trends like compact guns and military-style weaponry, has vaulted the company to the No. 4 spot on our list of the Best Small Companies in America. Since Fifer took over in late 2006 Ruger’s share price has jumped sixfold to a recent $49. Over the last 12 months it has netted $55 million on $406 million in revenue; half a dozen years ago it barely managed $1 million on $168 million in sales.

Read the whole article. It is a good read and doesn’t indulge in anti-gun hysteria. It did elicit this absurd comment from a reader named “Greg”.

The business of murder machinery can be highly profitable.

A good sin stock.

Sure, Greg, whatever. Nonetheless, I’m glad to see that Ruger has rebounded from the Bill Ruger, Sr. days and has adopted new ideas, new manufacturing techniques, and ditched the limited capacity magazine nonsense. As a shareholder, I’m doubly glad.

H/T Lars at NRA Blog

Ruger Has Another Great Quarter

Ruger released their 2nd quarter 2012 financial results yesterday and held an earnings conference call with investment analysts and those interested this morning. Suffice to say, Ruger had another great quarter.

CEO Mike Fifer reported that Ruger’s earnings were up 63% for the quarter compared to the same quarter in 2011. Earnings growth was driven by a 50% growth in sales as well as some operational efficiencies. Breaking down sales, new products introduced in 2012 accounted for 38% of sales in the first half of 2012. Fifer attributed the following new products for driving this 38% increase:

- Ruger American rifle

- SR22 pistol

- 10/22 Take-down rifle

- 22/45 Lite pistol

In terms of dollars figures, Ruger reported the following for the 2nd quarter of 2012:

The Company reported net sales of $119.6 million and fully diluted earnings of 91¢ per share, compared with net sales of $79.6 million and fully diluted earnings of 56¢ per share in the second quarter of 2011.

For the six months ended June 30, 2012, net sales were $231.9 million and fully diluted earnings were $1.71 per share. For the corresponding period in 2011, net sales were $155.1 million and fully diluted earnings were 99¢ per share.

Ruger’s unit sales or the number of firearms sold to distributors rose by 55% for the quarter. If one uses the NSSF adjusted NICS checks as a proxy for the industry as a whole, it only rose 18% during the quarter.

During the conference call, one analyst asked if the growth in sales for the LC9 were as a result of cannibalizing the sales of the LCP. Fifer replied, “Not in the slightest.”

Fifer was asked about the $9 million in capital expenditures during the quarter. He replied:

Well, the important thing to know about the capital expenditures as I described is that we recognize them when they are placed in service. Which is — so it’s when I order it, not when I put a deposit on machinery, not when the machinery arrives, not even when I just get the tools up, but when I actually start producing parts. So the fact that I recognize $9 million in the quarter, it means I had a lot of equipment start producing parts in the quarter.

Finally, there was a question about the backlog and whether the orders submitted were firm orders or not. Fifer replied that Ruger had a policy of only accepting firm non-cancelable orders. Part of the rationale behind the suspension of taking new orders this Spring was the company’s desire to maintain this policy. Prior to lifting this suspension, their sales staff worked with distributors reminding them to only order what they could actually sell to gun shops.

Ruger had a great quarter and with all the talk of new gun control measure plus the elections I fully expect them to have a very good 3rd quarter.

Note: In the interest of full disclosure, I am a shareholder in Sturm, Ruger and Company and have been for a number of years.

Ruger Has Stellar Quarter

The gun prohibitionists are desperate to promote the meme that the growth in NICS checks do not accurately reflect the growth in firearm sales. Unfortunately, they just cannot ignore financial statement releases from public companies such as Sturm, Ruger & Co. Financial statement releases from public companies are not only released to the public but filed with the Securities and Exchange Commission. They must be accurate unlike any statement made by the likes of CSGV and other gun prohibitionists.

Yesterday, after the close of the stock market, Ruger released its first quarter results and they were impressive. Their net earnings per share – profit – nearly doubled as compared to the same quarter in 2011. Moreover, they have orders in hand for 1.2 million firearms which exceed the number shipped in 2011.

The highlights of the results as pointed out by Ruger CEO Michael Fifer:

- Our earnings nearly doubled from the first quarter of 2011, driven by the 49% growth in sales and our ongoing focus on continuous improvement in our operations.

- New product introductions were a significant component of our sales growth as new product sales represented $40.8 million or 37% of sales in the first quarter of 2012. New product introductions in the first quarter of 2012 included:

- Ruger American Rifle

- SR22 pistol

- 10/22 Take Down rifle

- The estimated sell-through of our products from independent distributors to retailers in 2012 increased 62% from the first quarter of 2011. During this period, National Instant Criminal Background Check System (“NICS”) background checks (as adjusted by the National Shooting Sports Foundation) increased 23%.

- On March 21, 2012, the Company announced that it temporarily suspended the acceptance of new orders. In the first quarter of 2012, orders for 1.2 million units were received by the Company, which exceeded the total units shipped during 2011. The Company anticipates resuming the acceptance of orders at the end of May 2012.

- Cash generated from operations during the first quarter of 2012 was $21.8 million. At March 31, 2012, our cash, cash equivalents, and short-term investments totaled $95.8 million, an increase of $14.7 million from December 2011. Our current ratio is 3.1 to 1 and we have no debt.

- In the first quarter of 2012, capital expenditures totaled $3.0 million. We expect to invest approximately $20 million for capital expenditures during 2012.

- At March 31, 2012, stockholders’ equity was $149.8 million, which equates to a book value of $7.82 per share, of which $5.01 per share was cash and equivalents.

- On March 31, 2012, the Company completed the fourth and final quarter of its “1.2 Million Gun Challenge to Benefit the NRA.” During this year-long challenge, Ruger donated a total of $1,253,700 to the NRA. We believe that Ruger is the first firearms manufacturer to build and ship more than one million firearms in one year.

The financial tables that accompanied this release can be found here.

I am not an accountant but I generally can understand balance sheets, income statements, and statements of cash flows. Just looking at a few key items you see that their cash from operations increased by over $1 million dollars as compared to the same quarter in 2011, their net inventories are down, and their allowance for obsolete or slow moving inventory fell by almost 60%. The last two items tell me that not only are firearms flying out the door but Ruger is making mostly what people want.

If you have the time and the inclination, you can listen in on Ruger’s Annual Meeting which is today and starts at 9am. I’m sure you will hear lots of cheers from shareholders. If I could have been in New Hampshire today, I would have been one of those cheering the loudest as the stock is trading near its all time high and the quarterly dividend just tripled.

For instructions on how to view or listen to the annual meeting, go here.

A Couple Of Numbers From The NRA Annual Meeting

The attendance for the NRA Annual Meeting was just announced. The final number is 73,740 which is an all time record. If I remember correctly, the last meeting in St. Louis set a record.

The other significant number coming out of the NRA Annual Meeting was the number of firearms sold by Ruger over the past four quarters – 1,253,700. This is an all-time number for firearms manufactured and sold within one year by any one manufacturer. This also resulted in a check for $1,254,000 to the NRA as a result of the Ruger Million Dollar Challenge. They presented the check to the NRA at Friday’s Leadership Forum.

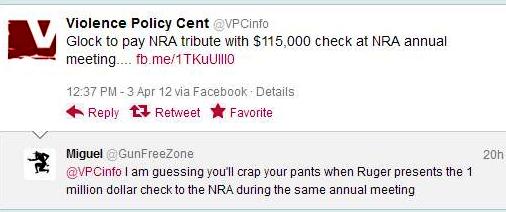

Oh, Those Evil Gun Companies And The Evil NRA

The Violence Policy Center has their panties in a wad over a donation that Glock, Inc. is making to organizations within the National Rifle Association. Frankly, I think they are jealous that the Joyce Foundation doesn’t give them this much money with which to put out more spurious reports.

I agree with Miguel that the VPC will have even more PsH’s when Ruger presents the final installment of their $1 million $1.2 million dollar challenge check to Wayne LaPierre at the NRA Annual Meeting.

From Glock’s press release in part:

Smyrna, GA – GLOCK, Inc. will donate a total of $115,000 to four separate organizations within the National Rifle Association (NRA) during the 2012 NRA Annual Meeting & Exhibits held in St. Louis, MO, Apr. 12 – 15. GLOCK, Inc. Vice Presidents Gary Fletcher, Chad Mathis and Josh Dorsey, alongside spokesman R. Lee Ermey, will make presentations to each group inside the GLOCK, Inc. exhibition booth (#2031) on Friday, April 13, 2012 at 10:00AM.

“There are millions of NRA members and thousands of certified NRA firearms instructors who continue to protect our Second Amendment rights and help to promote firearms safety,” said GLOCK Vice President, Gary Fletcher. “It’s important for us at GLOCK, Inc. to recognize that commitment by supporting the NRA and its affiliate organizations.”

The full release can be read here.

GunsAmerica Hasn’t Broken The Ruger News Embargo…Yet

Jim Shepherd had this announcement today in the Outdoor Wire about a new firearm set to be announced by Ruger.

Ruger Will Announce New Firearm This Morning

Later this morning, Ruger will announce a new firearm to the marketplace. We’ve shot the new gun-extensively-and have a review prepared for wire readers. Due to the release timing of today’s announcement, it does not appear in this morning’s editions. We will have the product review and information in tomorrow’s editions.

You may remember that GunsAmerica broke the news embargo on the release of the Ruger LCR-22 by announcing it earlier than allowed back in December. You also may remember that the head of GunsAmerica, Paul Helinski, objected to bloggers and other members of New Media being considered “media” at the SHOT Show and having access to Media Day.

I checked GunsAmerica earlier today and I guess they learned their lesson about breaking news embargoes.

If past history is any indication, Ruger’s PR staff will announce the new firearm around 11am EDT on their website and by email.

Since Sturm, Ruger is a publicly traded company they have to abide by SEC Rule FD governing the release of material information. The announcement of a new firearm is something that could impact their stock price and advanced knowledge of it would give an unscrupulous investor an advantage. This is why they have rigorous non-disclosure agreements and news embargoes.

The Stock Market Is Down Today

The headline from the Wall Street Journal at midday is “U.S. Stocks on Track for Third Decline.”

U.S. stocks fell after weak economic signals from the euro zone and China raised fresh concerns about slowing global growth.

After rising to multi-year highs in recent days, major benchmarks extended their retreat into a third session on Thursday. The Dow Jones Industrial Average declined 65 points, or 0.5%, to 13060 in midday trade.

Standard & Poor’s 500-stock index shed 9.4 points, or 0.7%, to 1393. FedEx FDX -4.29%was among the biggest decliners, after delivering a disappointing earnings outlook and cutting its economic growth forecast. The Nasdaq Composite slid 13 points, or 0.4%, to 3062.

However, you would never know that the stock market was down if you were following firearms manufacturers Ruger and Smith & Wesson.

From Active-Investor.com on Ruger today:

Sturm, Ruger & Company, Inc. (NYSE:RGR) is up 8% today at $45.68. RGR has traded 428 thousand shares this morning, about double its average volume. RGR shares are up this morning after the company announced it was not taking any new orders at this time due to overwhelming demand. The company added that it will begin taking new orders again sometime in May. The company has a market cap of 873.65 million.

And this on Smith and Wesson Holding Corporation from Active- Investor.com under the headline “Market Down Despite Jobless Claims at Four-Year Low, NASDAQ Stocks to Watch”:

Smith & Wesson Holding Corporation (NASDAQ:SWHC) is up 10.85% this morning at $7.65. SWHC is up on heavy volume today with 2 million shares traded so far, well above its daily average of 931 thousand shares. Smith & Wesson shares are rallying alongside its rivals today after Sturm, Ruger & Co. announced it has stopped taking new orders due to overwhelming demand. The company has a market cap of 503.52 million.

Investors seem to be pushing up RGR and SWHC while ignoring CSGV and VPC. Go figure.