Non-profit organizations are required to release and make public their IRS Form 990 filings. The Form 990 is their equivalent of a corporate tax return. The submission is usually almost a year after the end of the prior year.

Today, the Washington Post reported that the NRA’s 2019 Form 990 was made public. It has some interesting admissions contained within it. I’m just going to hit the highlights and will post a link to the actual Form 990 so that you can examine it for yourself.

From the article by Beth Reinhard and Carol Leonnig:

The tax return, which The Washington Post obtained from the organization, says the NRA “became aware during 2019 of a significant diversion of its assets.” The 2019 filing states that LaPierre and five former executives received “excess benefits,” a term the IRS uses to describe executives’ enriching themselves at the expense of a nonprofit entity.

The disclosures in the tax return suggest that the organization is standing by its 71-year-old chief executive while continuing to pursue former executives of the group.The filing says that LaPierre “corrected” his financial lapses with a repayment and contends that former executives “improperly” used NRA funds or charged the nonprofit for expenses that were “not appropriate.”

LaPierre has reimbursed the organization nearly $300,000 in travel expenses covering 2015 to 2019, according to the tax return, which does not explain how that amount was determined or when LaPierre paid it.

As was reported in the Wall Street Journal in October, the Internal Revenue Service is supposedly investigating Wayne LaPierre for criminal tax fraud. There is a lot of speculation that this tax filing which was signed by Wayne himself was a way to mitigate the damage of that investigation.

Three tax and accounting experts who reviewed the 2019 tax return for The Post said the disclosures show the organization and LaPierre trying to take responsibility and avoid further legal jeopardy.

“This is the type of cleanup I would expect to see after a history of gross violations of nonprofit law,” said Philip Hackney, an associate professor of law at the University of Pittsburgh who worked at the IRS for five years until 2011 providing legal oversight of tax-exempt organizations.

LaPierre personally signed the 2019 tax return; such a document is customarily signed by the organization’s treasurer. “He is putting himself on the line, under penalties of perjury, which is what you do if you are trying to get in someone’s good graces,” Hackney said.

New York lawyer and expert on nonprofits Daniel Kurtz said, “It’s a smart move by the NRA instead of digging in their heels, though who knows how they came up with the numbers. It’s an admission of wrongdoing, for sure.”

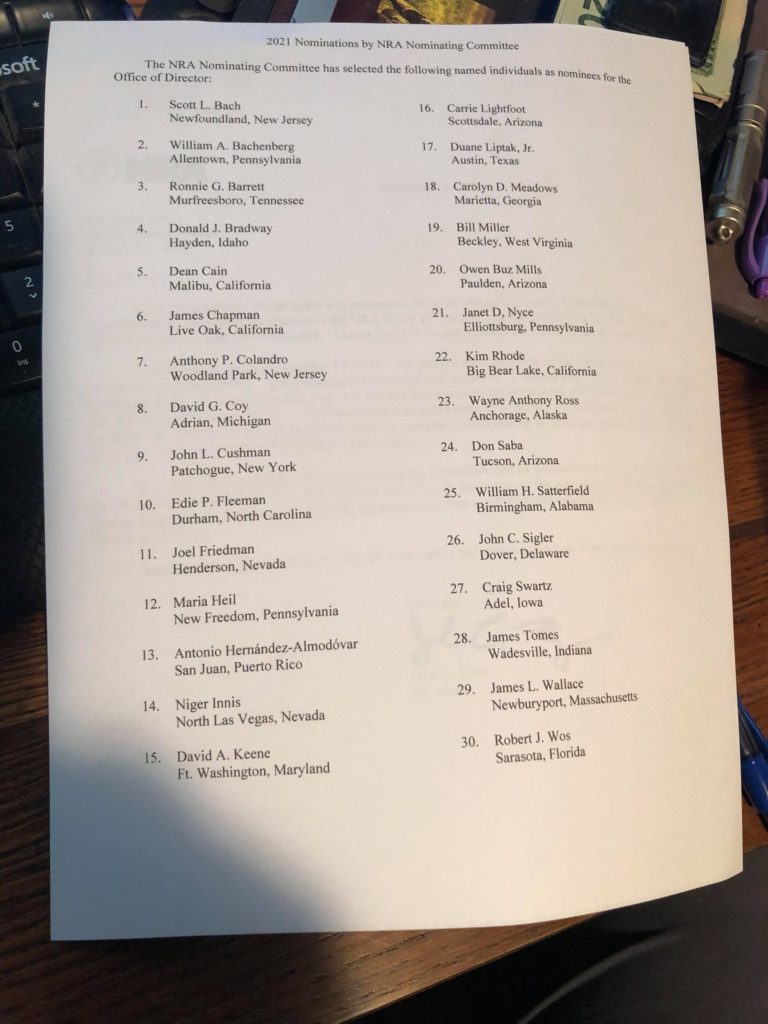

It also appears that this Form 990 is also trying to throw a number of former NRA executives such as Chris Cox and David Lehman of ILA under the bus along with Oliver North. Josh Powell is also mentioned as having received previously unreported excess benefits. Some undisclosed directors are also mentioned as having traveled First Class without “authorization”.

Cox resigned in June 2019 after LaPierre accused him and North of orchestrating a coup — a claim they both denied. The tax return says the organization is seeking to recover more than $1 million it says Cox improperly received for travel, meals and tickets to sporting events.

Cox’s lawyer, Tom Buchanan, called the allegation “false” and said all of the lobbyist’s expenses during his 24 years with the NRA were reviewed and never questioned. Buchanan said also that Cox has provided the New York attorney general with “thousands of documents” and has not been implicated in her investigation.

North was ousted as NRA president last year after accusing LaPierre of spending recklessly on legal fees for Brewer’s firm. The new tax filing says the NRA has “reason to believe” North received excess salary that he failed to earn. North declined through his attorney to comment on the tax return.

North has previously argued that the NRA has falsely accused him of financial improprieties in retaliation for his cooperating as a key witness in the New York investigation, according to pleadings in New York State Court.

“In public, the NRA has said these allegations of misspending were completely unfounded, but these official filings present a picture that a lot of the claims made were accurate and the only question is who was at fault,” said Brian Mittendorf, an accounting professor at Ohio State University.

A quick glance at the Form 990 shows that overall revenues were down by over $60 million and the ongoing operating deficit was $12.2 million for the year. Mind you, this is for 2019 which was pre-pandemic.

There is a lot more there. Now is the time I wish I had taken more accounting classes.

NRA 2019 IRS Form 990 by jpr9954 on Scribd

The really interesting stuff starts at about page 77 and goes from there.